Report: Crippling Student Debt is Forcing Students to Drop Out

It's graduation season and while colleges are advertising pictures of happy graduates in caps and gowns on their websites, there is one distinctive feature about the class of 2015 across the country: they have the most student loan debt in history.The average student who borrowed money for their bachelor's degree has just over $35,000 in debt. What is perhaps most alarming about this number is how much and how quickly this number is rising. Just from 2014, the number rose almost $2,000 and from ten years ago, the number is roughly $15,000 higher.

The rising cost of colleges, and thus loans, has been decried as a national outrage. U.S. Senator Elizabeth Warren (D-Mass.), who has been so far unsuccessfully working on a bill to lower interest rates on federal student loans, declared the student debt problem "an economic emergency...Forty million people are dealing with $1.2 trillion in outstanding student debt. It's stopping young people from buying homes, from buying cars and from starting small businesses."

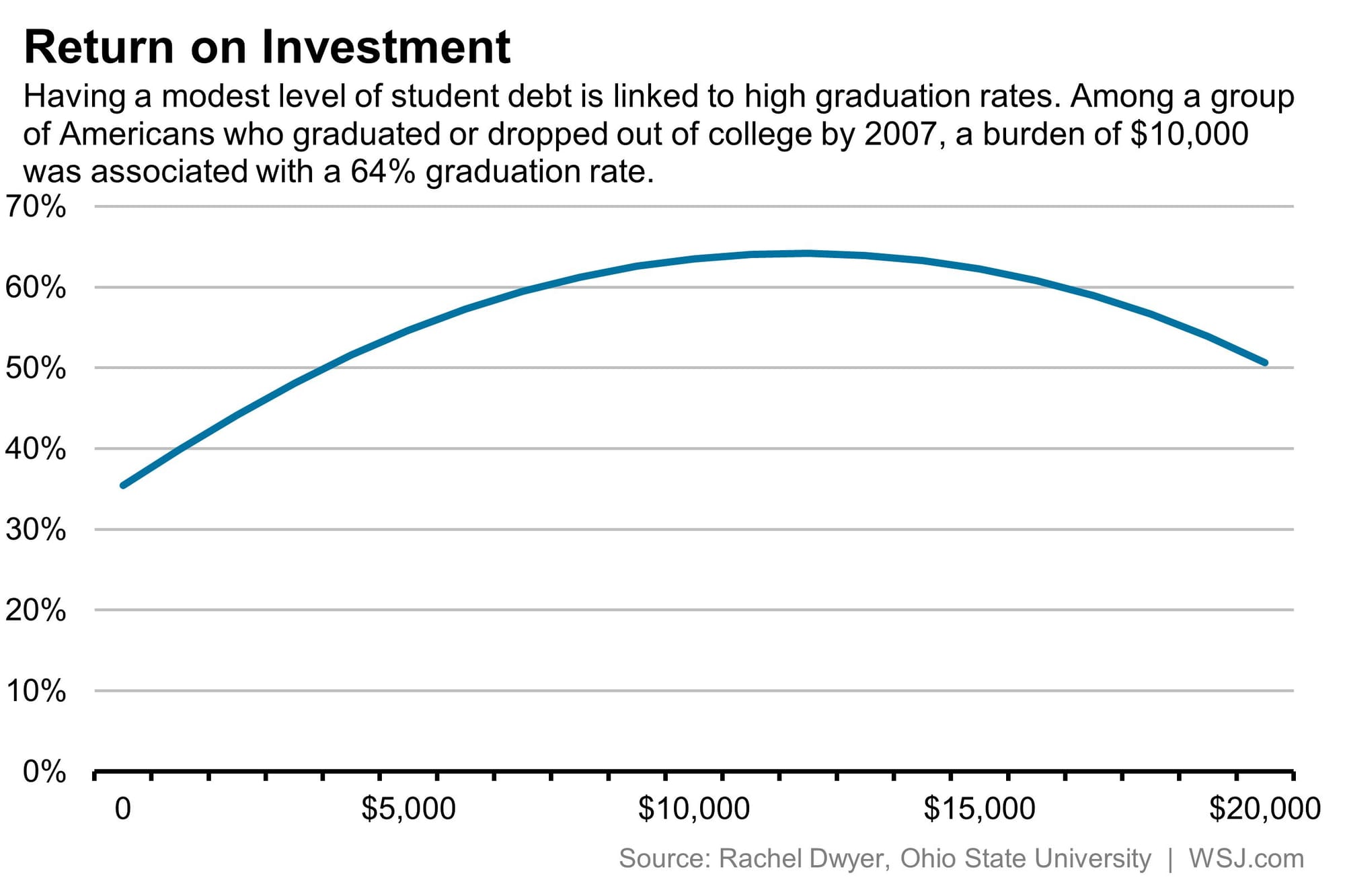

A new study though suggests that not all debt is bad. Third Way, a centrist think tank, published a study conducted by Rachel Dwyer, a sociologist at the Ohio State University, which argues some correlation between student debt and graduation.

Her findings result in a U-curve graph. As debt increases, students have a higher rate of graduation -- up to a certain point of $10,000. After that number, the percentage of college graduates decrease.

What this suggests is that the some students might see debt up to a certain level as an incentive motivating them to graduate up to $10,000. At too high a level, though, debt may be a disincentive to graduation because the burden becomes too high to take on.

With the average at $35,000 and increasing, it appears that the increasing rates of debt may be hurting graduation rates around the country.

Presidential candidates are now jumping into the fray. Hillary Clinton recently stated her desire to make college affordable to all by reducing interest rates on federal loans and increasing Pell Grants. Jeb Bush said he wants students to utilize low-cost options to reduce loan accumulation, such as online schools which tend to be cheaper. Governor Martin O'Malley instituted a tuition freeze as governor of Maryland to make colleges more affordable. Bernie Sanders wants to eliminate tuition by having the government pay two-thirds of the cost and then tax things like hedge funds to fill the remaining gap.

It is still almost 500 days until the next election but Dwyer's study suggests that student debt is a pressing issue that many politicians will be forced to address on the national stage.

Photo Credit: pogonici / shutterstock.com