Looking to the Founders: Wars, Debt, and the Hour of Reckoning

As odd as it might seem, the American Revolution was at least partly fueled by the Founder's resentment of England's foreign wars and public debt -- topics that are at the very heart of modern American political discussion.

Founding father Thomas Paine had a keen understanding of this and devoted an entire segment to it in The American Crisis. After 13 continuous years of war and almost 25 years of various "peace keeping" missions, perhaps we ought to revisit this topic and see what Paine foresaw as the end result.

While we remember "no taxation without representation" as the rallying cry, the underlying problem was slightly more complicated.

The American colonies were weary of the endless wars of Britain, they were tired of having to pay for them, and even worse, they were outright angry about being forced to use inflated British paper money that was diluting their buying power.

By 1776, almost 100 years of costly wars had caused the British currency to become diluted by massive amounts of unsecured paper currency injected into the market. Over £200 million in paper currency (over $8 billion in today's money) was secured by less than £16 million in gold and silver.

While Britain was entering the height of its colonial expansion, it had the lowest gold and silver reserves of all of Europe.The effect on the American colonial economy was significant. Early attempts -- in the form of issuing bills of credit -- by the colonies to combat the lack of hard currency failed miserably and created even more inflation, especially in the Northern colonies.

Adam Smith, in the Wealth of Nations, directly criticized the American colonies for "cheating" English companies by paying debts with inflated colonial currencies. While turnabout is usually considered fair play, English companies were not about to tolerate this for long.

Spanish silver was by far the preferred currency of the colonies and early republic. The early dollar would be pegged to the Spanish 8 real coin -- hence the term "two-bits," referring to our quarter-dollar coinage.

Of course, the British would not tolerate colonies preferring homemade paper or foreign currency, and the passage of several Currency Acts became a point of contention in the colonies.

The purpose of the Currency Acts was two-fold. First, by limiting the colonies' ability to circulate bills of credit (or any other form of paper currency), the Parliament was protecting British companies. Second, by demanding that all taxes be paid in British currency, it forced the usage of the diluted and inflated British pound sterling throughout the colonies.

When the first Continental Congress met in 1774, the Currency Act of 1764 was one of the 7 acts labelled as "subversive of American rights."

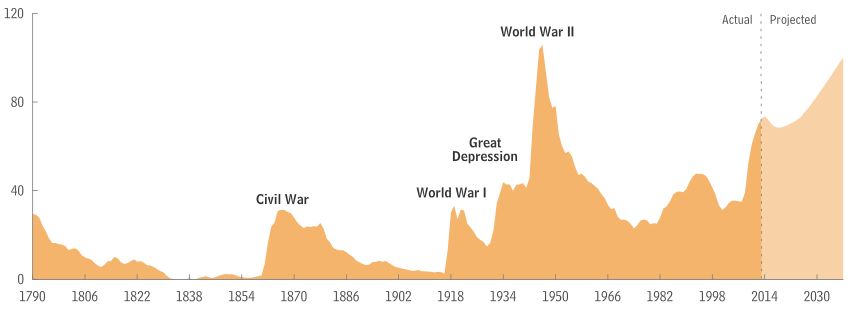

When measuring public debt as a percentage of GDP, it brings out the true costs of American wars -- with noticeable spikes during all major military involvement.

The notable exceptions to this were Korea and Vietnam, both occurring during levels of unprecedented growth to the American economy coupled with the political belief that a "guns and butter" economy could sustain both private sector growth and increased military expenditure.The "guns and butter" economy only delayed the debt spikes from Korea and Vietnam until the end of the Cold War when increased military expenditures, coupled with a slowing economy, would see the national debt top $1 trillion and then soar to almost $4 trillion during the final decade of the Cold War.

We have the finest military ever to exist -- with more than two million men and women in active and reserve service, as well as the world's most powerful navy and air force.

But like the 18th century British, we are feeling the economic pangs of sustaining the world's most powerful military -- topping over 17 percent of the total U.S. budget in 2013.

We currently have two enormous problems with no apparent exit strategy -- how to resolve the Iraq wars once and for all and how to deal with a debt that is approaching 100 percent of GDP.

Paine closed by mocking General Howe, saying that he was still at square one after three unsuccessful campaigns in the colonies:

You have now, sir, tried the fate of three campaigns, and can fully declare to England, that nothing is to be got on your part, but blows and broken bones, and nothing on hers but waste of trade and credit, and an increase of poverty and taxes.

Paine foretold that at some point, both England and Howe would have a melancholy hour when their actions against the colonies would be judged. To Paine, there was no sin greater than "that of willful and offensive war."

Much like General Howe, the United States is now in its third campaign in Iraq, with no measurable gains except increases to our national debt and damage to our international credibility.

Probably the best prophet of the early Iraq war was Secretary of State Colin Powell's "Pottery Barn" warning to President Bush that if we break it, we'd have to buy it:

You are going to be the proud owner of 25 million people. You will own all their hopes, aspirations, and problems. You'll own it all.' -- Colin Powell, summer 2002

And while America is going to try to fix the Humpty-Dumpty nature of the Iraqi infrastructure and society for some time, our melancholy hour could take place much closer to home.

Like 18th century England, our currency is being perceived as diluted and inflated throughout the world.

After WWII, the U.S. dollar became the de facto global reserve currency under the Bretton Woods system. Currencies were pegged by treaty to the dollar in effort to eliminate the hyperinflation that had plagued much of Europe after WWI.Even though the Bretton Woods system is long past, the dollar is still the reserve currency for one primary reason: worldwide oil transactions are denominated in U.S. dollars.

China and Russia have both renewed calls for an international super currency free from politicized monetary policies, while OPEC nations edge ever closer to using euros for oil transactions.

Former Federal Reserve Chairman Alan Greenspan predicted in 2007 and again in 2012 that worldwide oil transactions in euros would become an eventual reality.

Considering that the United States imports over 10.6 million barrels of oil each day, this represents a significant loss of financial control on the world stage.

There is no quick fix to this problem. It wasn't created overnight and it definitely won't be fixed in one session of Congress or even during one election cycle.

The continued decline of the dollar against the euro is evidence that Fed Chair Janet Yellen is opting to continue the weak-dollar policies of her predecessors -- a strategy that will haunt us if the world decides to ditch the dollar.

The British spent most of the 19th century in one-after-another bank failures because they couldn't ever find a solution to their weakening currency. We have already had one banking crisis. We need to make sure that it doesn't become the "new normal."

Solutions to these problems can be found, but at what cost?

The signers of the Declaration of Independence were willing to 'pledge to each other our lives, our fortunes and our sacred honor"-- everything they had to ensure victory. What are we willing to risk?

Image: Thomas Paine by Auguste Millière