Wage Stagnation in America Causing More Poverty

A recent article in the press noted that over half of all jobs pay under $20/hr. But what does that really mean in terms of the long-term wage stagnation and increasing poverty in the United States?

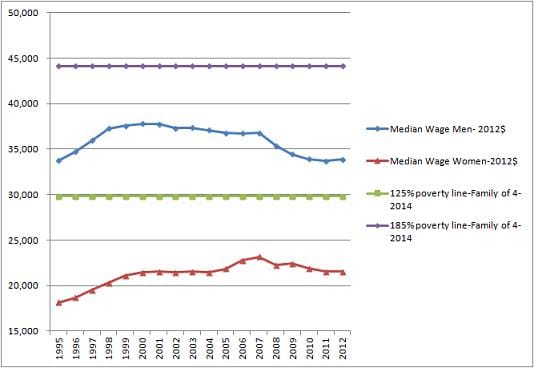

According to the Census Bureau, the median wage for men (adjusted for inflation) from 1995-2012 has hovered around $35,000 per year -- working out to about $16.83 per hour. For women, there has been a growth trend from 1995-2012, but still hourly wages are roughly $10.58 per hour.

For households it's just as bad. From 1995-2012, the median household income hovered around $51,000 in inflation adjusted wages -- only 214 percent of the poverty level (bear in mind that many federal benefits start at 185% of the poverty level).

A common criticism used is that the poverty level is set too high, which means there really should be fewer "poor" people in the United States. The argument goes something like this: "redefine poverty and the poverty problem is solved -- there aren't as many poor people."

In almost Soviet-style propaganda, the war on poverty could be completely won by setting the poverty level at zero income.

This, of course, is ridiculous. The poverty levels were developed to demonstrate what could be bought at the level of poverty.

In 1963, the Department of Agriculture first defined poverty as triple the amount of money required to purchase a low-cost, balanced, healthy diet. Since 1963, the methods have changed slightly, but the definition of poverty still does not include "necessities" like housing and utilities.

The method still essentially measures the ability of the family to feed itself. The 2014 poverty level for a family of four is $23,850 -- divide this by 3 equals $7,950. Divided by 12 months, this gives a monthly food budget of $662.50. Continuing the calculation, this works out to living off of $5.52 per day for food (which is very similar to the so-called "food stamp challenges" that have become popular in recent years).

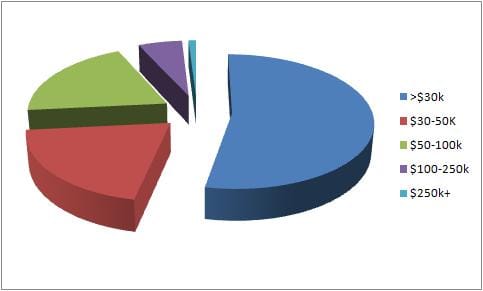

*Based on the 153.6 million American wage-earners, as defined by the Social Security Administration.

With over half of all wage earners making poverty wages, the middle class is becoming a thing of the past. While two-income families were the norm for much of the 90s and 00s, Millennials are setting a new trend of single-income families with one parent staying home to take care of the children. According to a new report, upwards of 60 percent of Millennials intend to raise a family on a single income.

While the gut-reaction might be that this will cause more poverty, in the long-run, if the trend continues, it will serve to raise aggregate wages by making the employment pool smaller. Reviewing the household data, wages remained stagnate from 1995-2012 while the number of households increased by over 25 percent. A lot of wage stagnation can be attributed to healthier living, allowing for longer careers.

A recent report stated that Walmart, arguably one of the worst paying companies in America, could increase wages with little impact on prices or profit. In fact, according to this report, Walmart could raise wages so that all of their employees were above the 185 percent poverty line and it would only affect prices by about 1.4 percent.

It is estimated that Walmart's low wages cost the government over $300,000,000 per year in SNAP (food stamps) alone. Most are aware that America's consumer goods are made with sweatshop labor, but this strikes closer to home. The "real" price of seeking out the cheapest goods possible comes with too high of a social cost.

To make the hypocrisy even worse, in Walmart's most recent SEC filings they warned that profits would be lower due to lapses (due to temporary increases ending) in the SNAP program. Currently, 18 percent of all SNAP benefits are spent at Walmart stores. When even the corporate giants are suffering from welfare reductions, those who need it most are in enormous trouble.

Well-paying jobs are the answer to wage stagnation. Whether it's a massive government-sponsored jobs creation program or keeping domestic companies from going overseas to pay slave wages to pad profits, our economy needs new and better paying jobs.

But then again, it's always easier to believe that 153 million Americans are being lazy than it is to believe that a couple of thousand Americans are suffering from out of control greed.

Photo Credit: Marco Scisetti / shutterstock.com