Raising The Minimum Wage Will Fail; Eliminate Unemployment

There is considerable news in the press about setting the minimum wage at $10.10 per hour. Recently, Connecticut became the first state to pass this as the minimum wage. Is this the answer? Or is the answer a program that seeks to eliminate unemployment?

Anyone who has ever taken an entry level economics class has seen the graph for the labor market with supply and demand meeting an equilibrium point. Under that model, unemployment is solely caused by wages being higher than the equilibrium point -- either because the government has set the minimum too high or market forces have set the demand too low. This model, although widely popular, is of course inherently wrong.

The underlying assumption of all neoclassical economic models is an economy that is producing at full capacity -- something that is a phantasmagoric self-deception that has never been attained in the Industrial Age. If anything, production is intentionally sabotaged to increase prices (i.e. price supports that pay farmers to not produce crops and purposefully constraining production to not "flood the market").Economic theories are typically religious ideals, an explanation of how things would work under the most "ideal" conditions. While there's a common sense logical appeal, they cannot be used to cast a broad net to explain every situation.

Most companies that make cuts in the labor force do so because of their internal cost structure and not because of external market forces. If cuts were truly because of external market forces, all lay-offs would be preceded by an offer to lower wages. While this does occasionally happen, it is extremely rare.

Minimum wage laws make companies wary of their increased cost structures. Regardless of market forces, companies react to perceived threats to profit. This paranoia always results in a backfire -- companies inherently respond by reducing the workforce.

There has to be a better way, but before you can ever discuss full-employment, you have to address all the naysayers...

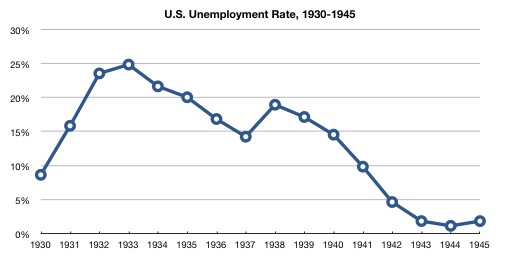

Source: Bureau of Labor Statistics

The minute you ever start talking about any plan for full employment, you always have to silence those who will attempt to shout you down with arguments about uncontrollable inflation. The closest that America has come to full employment was during WWII, with unemployment rates below 3 percent.

Even though the government was injecting enormous amounts of cash into the economy to fight the war, interest rates on government bonds were still under 3 percent. There was a spike in inflation, but it was similar to the inflation rates of the 1970s when unemployment was hovering around 7 percent and government bonds were paying 10 percent or more -- you can hardly correlate the two.In most cases of hyperinflation, unemployment precedes the hyperinflation; it is generally not the driving force. It is a further case against unemployment having an explicitly causal role in inflation. An exception to this is Weimar, Germany, where unemployment fell to 1 percent in the year preceding the hyperinflation, but any serious analysis would show that there were multiple driving forces behind the hyperinflation.

Proponents of the Phillip's Curve argue that it is a mathematical reality that full employment causes inflation; yet once again, there are fundamental assumptions in the model that have never been attained in "real life" production. Full employment does not mean full production. It never has and it never will.

Currently, unemployment benefits and various welfare programs give people the worst "disincentive" possible -- they are paid to do practically nothing. There are always those in society who have legitimate reasons to not be in the labor force: disability, education, familial status, etc. Yet, by definition, the unemployed want meaningful employment.

Because unemployment is a state-operated program, we rarely see the cost of what this program is on a national level. In 2012, the Congressional Budget Office announced that state and federal unemployment programs had cost $520 billion over the preceding 5 years. A more recent study showed that jobless Millennials, a segment with double-digit unemployment, are costing the government $8.9 billion per year.

So here's a novel idea: what if unemployment as it exists was totally eliminated, and then the government pays people to do the "undone jobs" of society when they can't find other work? Whether it's picking up trash on the freeways or visiting people in nursing homes, there are countless jobs which benefit all of society that are left undone.

Instead of being paid to do nothing (other than to turn in however many applications per week required), "jobless" people work for their benefits. And even if its built into the system that there is time allotted to go job hunting, this would be a program that is a win-win. Historically, this type of program has produced enormous benefits to society.There are countless WPA projects built over 85 years ago that society is still benefiting from today. In my own locale, thousands of wind breaks were planted by WPA programs that still help to prevent erosion. In the South, there are thousands of acres of forest. Hundreds of thousand of park benches and picnic shelters were built that are still in use today. These are just the "small" programs that don't include things of the magnitude of the Hoover Dam.

What's more, there is no need for a federal minimum wage at that point. Whatever the government pays is the de facto minimum wage, because the government is willing to absorb all idle labor. Able bodies who refuse this work are truly not unemployed -- the definition of unemployed includes only those who are willing, able, and actively seeking and accepting meaningful employment.

Naysayers would point out that this program would cost between 0.5-1 percent of GDP, but we are already paying at least a quarter of that amount to people who are doing absolutely NOTHING! This isn't even counting SNAP, WIC, and other social program benefits that the unemployed and underemployed are being paid.

The emerging markets of India and Argentina have both employed similar programs, and while there were definitely growing pains with these programs, there has been an overall improvement to poverty and unemployment.

There are times when the government should give a fish, but most often, the government needs to provide a fishing line and a place to fish.

For more information, professors L. Randall Wray and Stephanie Kelton at the University of Missouri-Kansas City have published numerous articles and working papers on the subject of achieving full employment while maintaining price stability, based on extensive study.