Student Loan Debt Continues to Rise as Interest Rates Double

Congressional leaders were unable to come to a conclusion on how to deal with federal student loan interest rates. July 1st was the deadline, but that interest rate will double from 3.4 percent to 6.8 percent. Student loan debt rises every minute and it has reached a total of $1 trillion. Higher interest rates can accelerate the issue.

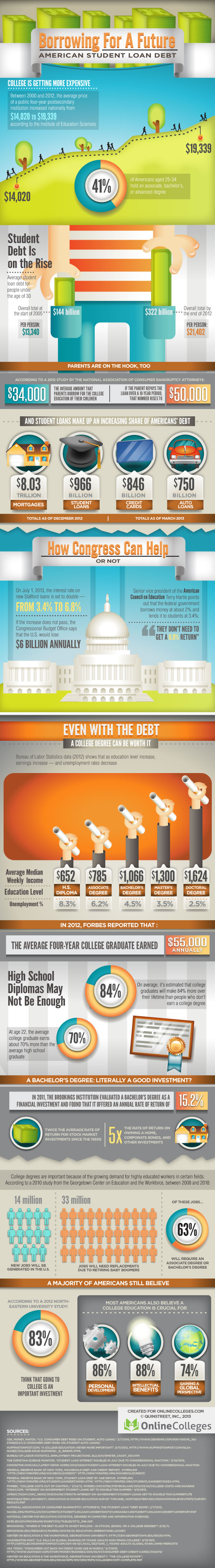

The infographic below, provided by OnlineColleges.com, outlines the pressing issue of student loan debt in the United States.

Some key points made in the infographic:

- From 2000 to 2012, annual tuition costs for a four-year college rose from $14,020 to $19,339.

- About 41 percent of Americans, ages 25 to 34 have attained some form of higher education.

- Average student loan debt per person went from $13,340 in 2005 to $21,402 in 2012.

- Student loans are the second largest debt burden (nearly $1 trillion), higher than credit card and auto loans, but only behind mortgages.

The increase in student debt burden is also said to adversely affect economic activity by $6 billion.

Despite the grim outlook on the debt burden to attend college, it is still a worthy investment. Average annual earnings for new graduates with bachelor's degrees was $55,000. The Brooking Institutes finds that college has a 15.2 percent rate of return on investment. Unemployment drops significantly with higher degrees, as well.