UC Interest Rate Swaps Mitigated By Prop 30 Funds, Study Finds

In an attempt to alleviate potential debt obligations, the University of California (UC) Board of Regents took on interest rate swaps. A group of doctoral students from UC Berkeley's sociology department published a study looking into the negative effects of these interest rate swaps. The study concluded that Proposition 30 funding for the UC system will be used to mitigate the cost of the swaps. UC Chief Financial Officer Peter Taylor published a rebuttal in support of the system's decision.

An interest rate swap is a financial decision to trade a variable-rate loan for a fixed-rate loan. The swap is intended to play the financial markets safe by avoiding potentially high variable interest rates. If interest rates are higher than the fixed rate on a loan, then the swap is successful. If interest rates plummet and the fixed rate is above it, then the swap is unsuccessful.

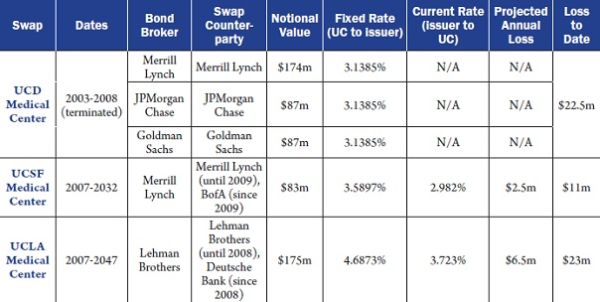

The doctorate students who are critical of interest rate swaps point out the costs of Regents' decisions:

These swaps have turned out to be losing bets. UC is taking huge losses because interest rates plummeted following the financial crisis of 2008...and have stayed at record lows. Swap deals already have cost UC nearly $57 million, with $200 million more in losses anticipated.

Credit: http://publicsociology.berkeley.eduIf the losses anticipated are a reality, then essentially the $250 million in revenue from Prop 30 for the UC system will be offset. Funds would go towards the large banks who agreed to the swaps.Students involved in this study recommend three actions to help moderate losses. First, they recommend renegotiating the details of the swap agreements with both Bank of America and Deutsche Bank. Second, UC should seek litigation regarding the LIBOR scandal since variable rates were affected by LIBOR. Third, there should more financial transparency for stakeholders within the UC system.University of California's CFO Peter Taylor points out that the UC interest rate swaps take the risk out of bond payments. He says the students inherently suggest keeping variable-rates. He defends swaps saying it's a safeguard for taxpayers who fund the UC system. Taxpayer money should not be subject to the risk of floating interest rates. Taylor criticized the Berkeley doctoral students, stating a lack of financial expertise and calling their findings simplistic:

Credit: http://publicsociology.berkeley.eduIf the losses anticipated are a reality, then essentially the $250 million in revenue from Prop 30 for the UC system will be offset. Funds would go towards the large banks who agreed to the swaps.Students involved in this study recommend three actions to help moderate losses. First, they recommend renegotiating the details of the swap agreements with both Bank of America and Deutsche Bank. Second, UC should seek litigation regarding the LIBOR scandal since variable rates were affected by LIBOR. Third, there should more financial transparency for stakeholders within the UC system.University of California's CFO Peter Taylor points out that the UC interest rate swaps take the risk out of bond payments. He says the students inherently suggest keeping variable-rates. He defends swaps saying it's a safeguard for taxpayers who fund the UC system. Taxpayer money should not be subject to the risk of floating interest rates. Taylor criticized the Berkeley doctoral students, stating a lack of financial expertise and calling their findings simplistic:The proper comparison is between the two choices that the university did weigh: getting to a fixed rate with a swap or with traditional fixed-rate bonds. UC has used swaps only when the advantage is significant. When this comparison is done correctly, it shows that UC has saved more than $40 million through the life of the bonds through swaps.