Who is Responsible for the National Debt?

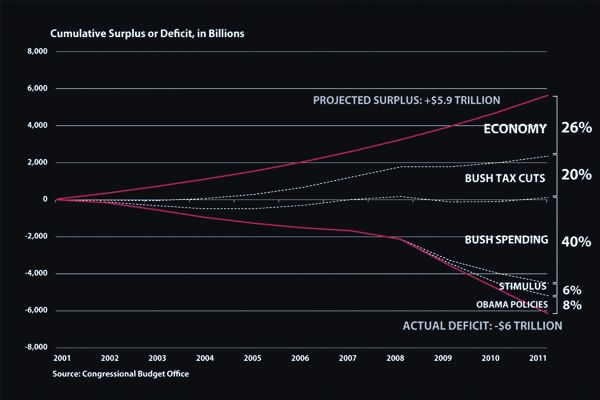

On January 31, 2001 the Congressional Budget Office released an economic outlook report projecting a surplus of $5.9 trillion into 2011.

“In the absence of significant legislative changes and assuming that the economy follows the path described in the report, CBO projects that the total surplus will reach $281 billion in 2001. Such surpluses are projected to rise in the future, approaching $889 billion in 2011 and accumulating to $5.6 trillion over the 2002-2011 period.”

The report went on to conclude that despite indicators that the economy was slowing down, economic shrinkage was destined to be short lived. The CBO projected, given that economic policy remain largely unchanged, GDP would begin to rise at 3 percent per year beginning in 2002. "Assuming that current tax and spending policies are maintained, CBO projects that mounting federal revenues will continue to produce growing budget surpluses for the next 10 years."

A month later, the Bush administration released ‘A Blueprint For New Beginnings.’ The 200-page document outlined the President’s vision for significant reductions in government spending coupled with what would become known as the Bush-era tax cuts. The report criticized the growth in government spending that would be aided by budget surpluses, and expressed a philosophy whereby tax cuts would encourage economic growth.

“[The Bush] tax relief program acts as a near-term insurance policy against an unwanted deepening of the current slowdown and should help growth return more quickly to a robust pace. Tax relief will also help to boost the economy’s underlying rate of long-term growth”

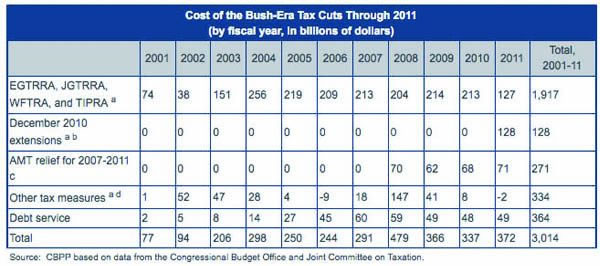

The Center on Budget and Policy Priorities, a research and policy think-tank focused on middle and low income issues, estimates that these tax cuts reduced revenues by almost $2 trillion from 2001-2008. This loss in revenue constitutes about 20% of the United States’ budgetary shortfalls when compared to the original CBO projection from 2001.

The Center for American Progress, a progressive think-tank, has outlined further contributors to this disparity citing data from the Congressional Budget Office. Their report shows that under-performance of the economy from 2001 to 2011 carved out almost 26 percent of projected surpluses. Additionally, the wars in Iraq and Afghanistan and increased spending under Bush comprise about 40 percent of the discrepancy between original projections and present conditions. President Obama’s policies including extending the Bush tax cuts and stimulus spending have contributed 14 percent overall.

In raw terms, since Obama took office, the debt has increased by $5 trillion. A variety of factors have contributed to this, including his extension of the Bush tax cuts in 2010 and continued military involvement overseas.

Slower than anticipated economic growth, coupled with government spending from 2001 onwards, are the primary contributors to today's mounting federal debt. It is possible however, that the Congressional Budget Office was simply wrong in their original assessment, overestimating the impact that policies at the time would have had going into 2011. These figures highlight the extent to which decisions made in the past can dramatically impact future fiscal realities.