Who Owns American Debt?

The most talked about issue this election, and over the past four years, has been the United States’ debt. 'Are we in a debt crisis?' 'Will China foreclose on America?' 'America is drowning in debt', are just a few of the headlines often brought up during the conversation surrounding America’s debt. The question remains, who owns American debt?

Simply put, ‘the debt’ is the amount of money the United States government must borrow to cover expenditures when it does not collect enough revenue. Everything the government does, from fueling aircraft carriers, to federal entitlement programs like social security and Medicare, to paying the salaries of elected officials make up these expenditures.

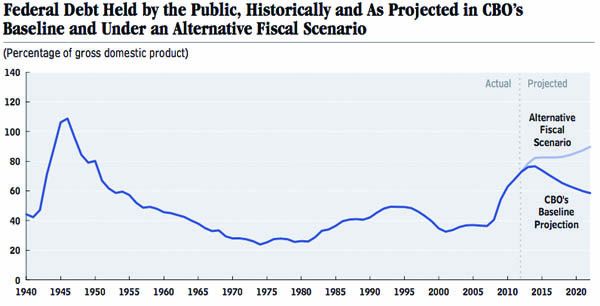

The debt, issued by the U.S. Treasury, is usually calculated by finding the aggregate disparity between America’s Gross Domestic Product and annual debt obligations. Current US debt is clocked at about $16 trillion dollars, whereas this years projected GDP is estimated at $15.6 trillion.

credit: Government Accountability Office

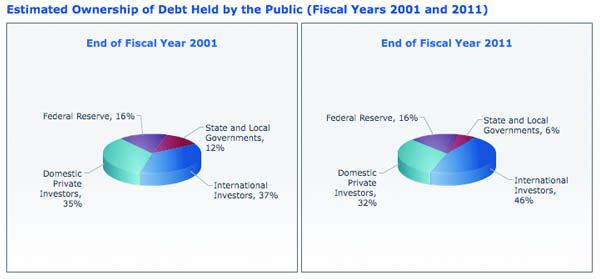

The government borrows from various global entities including domestic investors, enabling the US to technically owe some of its debt to itself. As of the end of 2011, foreign ownership of U.S. debt has increased almost 10 percent, from 37 percent in 2001 to 46 percent. The other, domestic, 54 percent is made up of: private investors, 32 percent, state and local governments, 6 percent, and the Federal Reserve, 16 percent.

When looking at foreign debt obligations specifically, it is true that China is the largest foreign owner of US debt, but Japan is a very close second and could overtake China in the coming years. A treasury department report calculated using data through August 2012, found that China holds nearly $1.2 trillion in Treasury securities whereas Japan holds about $1.1 trillion. This constitutes roughly 40 percent of all foreign Treasury securities. The third largest holder of these securities is a coalition of oil exporters, which includes Ecuador, Venezuela, Indonesia, Bahrain, Iran, Iraq, Kuwait, Oman, Qatar, Saudi Arabia, the United Arab Emirates, Algeria, Gabon, Libya, and Nigeria. These countries combined hold $260 billion in U.S. Treasury securities, less than 5 percent of the total.

credit: Government Accountability Office

While looking at China and Japan’s massive fiscal investment, the typical inclination is to be suspicious. The Government Accountability Office notes several reasons why any country would buy so much American debt.

“Treasury securities are attractive to investors because they are backed by the full faith and credit of the United States government, are offered in a wide range of maturities, and are exempt from state and local taxes… A key reason investors purchase Treasury securities is because they are liquid—that is, investors can easily trade the security because there are many people interested in buying and selling at any given time… In 2011 daily trading volume in Treasury securities averaged more than $550 billion, compared to approximately $900 billion in total trading in U.S. bond markets. Trading volume of Treasury securities remained robust during the financial crisis in 2008 and 2009 when investors were generally uncertain about the financial condition and solvency of financial entities. Treasury securities were viewed as a 'safe haven' investment.”

Over the last decade, the trend regarding US debt ownership has been a dramatic increase in foreign investment while domestic investment by individuals and local governments has decreased.

Domestic entities like private U.S. citizens, banks, and pension funds compose the second-largest percentage of debt ownership, at 32 percent. The Federal Reserve is next in line at 16 percent.

The Federal Reserve purchases a large amount of US debt in order to implement monetary policies that are intended to stimulate growth or stabilize the economy. These ‘open market operations’ consist of buying or selling Treasury securities in order to raise or lower the interest rates at which banks lend to one another and, transitively, the rates charged to consumers.

The staggering amount of US debt has not come without consequences. During the August 2011 debt ceiling debacle, the US lost its AAA credit rating when Standard and Poor’s downgraded it to AA+.

If the US doesn’t slow or reverse the accumulation of debt sometime in the near future, even greater economic repercussions might result. The common threat of China cashing in and taking over is absurdly unlikely, but other negative consequences still loom.