City of Los Angeles Bankruptcy May be Coming

A City of Los Angeles bankruptcy could be nearing, with the city a victim of the same unfunded public pension liabilities that are crippling municipalities like Stockton and San Bernardino across California, and elsewhere as well.

A Stanford study sums up the dismal figures. The percentage growth for spending on pensions is greater than that for public safety.

In 1999, Los Angeles City’s aggregate annual required contributions for its three systems totaled $291 million, rising to $923 million in 2011, an annual average growth rate of 11.1 percent. This growth outpaced that of spending on public protection, which grew at 5.2 percent, on health and sanitation (3.6 percent), and on recreation and cultural services (5.8 percent), and it occurred while spending on public assistance programs fell by an average of 3.0 percent per year.

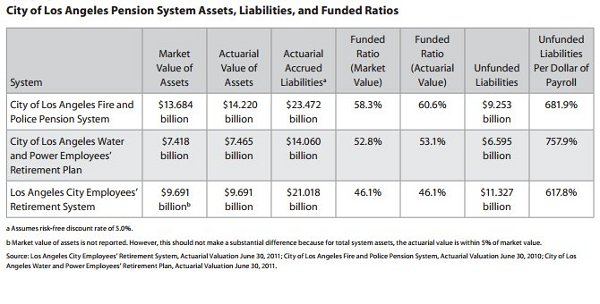

It gets worse. Unfunded liabilities for the three public pension funds in Los Angeles approach $27 billion; this for a city that already has a budget deficit and is struggling to pay its bills. Former L.A. Mayor Richard Riordan is looking prescient now for his declaration in a 2010 Wall Street Journal editorial that L.A. would go bankrupt by 2014.

Los Angeles is facing a terminal fiscal crisis: Between now and 2014 the city will likely declare bankruptcy. Yet Mayor Antonio Villaraigosa and the City Council have been either unable or unwilling to face this fact.

Two years later, Villaraigosa and the City Council are still unwilling to face the stark fact that Los Angeles has about run out of money. Instead, they continue the tired and intellectually dishonest practice of pretend-and-extend so favored by Sacramento. Pretend everything is fine then use accounting trickery or borrowing extend the problem out for a few more months. But this solves nothing and just makes things worse when the inevitable financial reckoning comes (or should that be “wreckoning”?)

Riordan says the city council is beholden to public unions and that pensions and salaries are higher for city workers than in the private sector. Mayor Villaraigosa has attempted a few reforms like raising retirement ago to 67 from the current 55 or 60 and prohibiting retirement at 100% of pay. But the unions have fought even this.

This may blow up in their faces because a bankrupt entity has the ability to break existing agreements.

Pension expert Marcia Fritz said that all of the city’s employees should pay at least half of pension costs. "This eliminates the employer paid pension contribution and will reduce pension costs as a whole," she said."Another thing L.A. should do," if bankruptcy becomes reality, "is break retiree health contracts," she said. "They weren’t prefunded, so are empty promises, and courts have allowed retiree health to be lumped in with other unsecured creditors."

Do the unions really want to play chicken with bankruptcy court?