Understanding the LIBOR Scandal Effects and How it Worked

Understanding the LIBOR scandal that has dominated financial news outlets these past weeks can be a challenge for most. Confidence in banks and what about this particular financial scandal is worth attention?

The London Interbank Offered Rate (LIBOR) is the average interest rate set for borrowing between banks. Barclay's, a British national bank, is the main perpetrator at the moment in the rate fixing scandal. The timeline on the rate fixing is unclear. Evidence shows the activity began in 2005 and ran as late as 2009. A scandal of this scale is not Barclay's own doing. They are providing evidence of participation within its own government and American banks. What is important to note is how the LIBOR fixing worked its impact on the world.

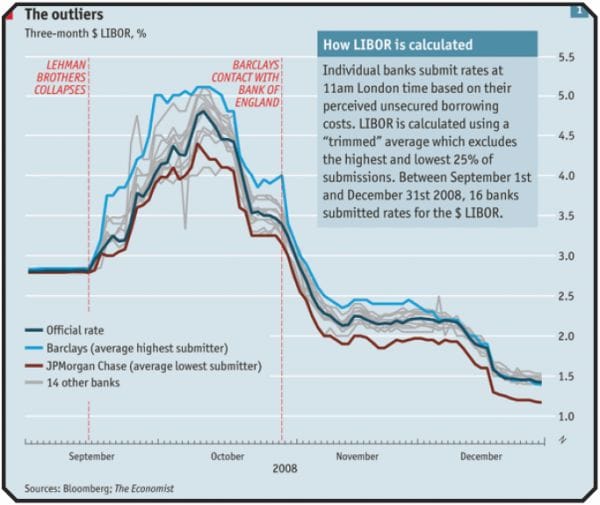

LIBOR is set subjectively and informally, without evidence of bank performance. British Bankers' Association (BBA) receives estimates from its member banks and trims their estimates to an average. Barclay's could not have done this alone since other banks must submit their estimate rates.

An example of the rate-fixing can be seen in this chart outlining rates in 2008. What's seen here is the illusion that Barclay's was financially healthy. This is so that the bank could borrow money at lower rates than it probably should have.

LIBOR scandal effects have important implications to those outside of the financial industry. Half of variable-rate private student loans factor in the LIBOR. Many variable-rate mortgages also use LIBOR. What the banks have done is work with each other to set the LIBOR to benefit their trading positions. The real purpose of LIBOR is in estimate of confidence in borrowing from other banks.

A series of emails between bank officials have surfaced and are primary evidence for the scandal. The informality of these officials could either been seen as humorous or disgusting. Bob Diamond, the former CEO of Barclays, is currently defending the bank and complying with authorities. There is a current investigation in the United States and United Kingdom relating to banks' participation.

Comprehending the LIBOR scandal effects is hard for those affected by it. This latest financial fiasco could be the final instigator for strict financial regulation. The people's trust in banks may fall even lower, leaving banks a less significant enterprise. For those with a loan or mortgage tied to LIBOR, your rate was played with to benefit bankers.