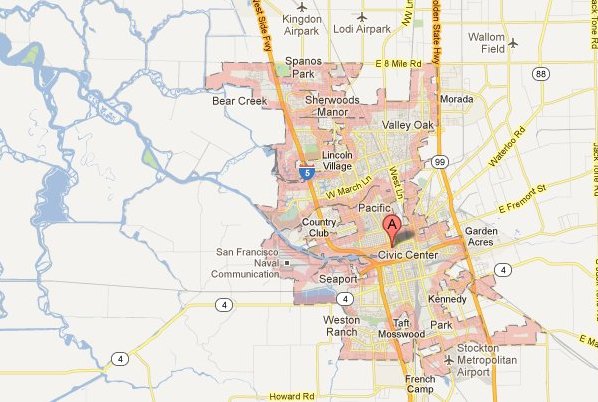

Stockton California on Track to Be Largest City to File Bankruptcy

On Tuesday, Stockton California said talks with creditors had failed and prepared to file Chapter 9 bankruptcy. They will be the largest American city ever to do so and the results will be closely watched by other struggling municipalities, public employees, Wall Street, hedge funds, and bondholders alike. If Stockton is able to structure their debt and pension obligations, then other cities will be emboldened to do the same.

Stockton has $700 hundred million in bond debt and has suspended payments. Their problems began during the real estate boom. Real estate prices were soaring everywhere. People who worked in the San Francisco Bay Area began buying homes in Stockton because prices were substantially lower even if it meant a sometimes brutal commute. The local economy boomed and the city began ambitious redevelopment plans, going into debt to fund them. The silent ticking time bomb is all this was the increasing amount of public pension obligations. When the real estate market crashed, the economy of Stockton did too. Tax revenue fell sharply. But its economy was mostly based on being a bedroom community and thus it had little to fall back on when the foreclosures mushroomed and the economy tanked.

Imagine if you will, that you are a retired public employee of Stockton, like John Skaff who requires knee replacement surgery and is being told his retirement medical benefits will be so deeply slashed that he may not be able to afford the surgery. Some say pension benefits were bloated, but there’s a human side of the story here too. Public employees who paid into the system for decades in expectation that they would get what was promised are now being told this isn’t so.

Solutions are needed to address the growing problem of municipal insolvency, not our same tired hyper-partisan blame game where Republicans fault Democrats and labor unions and Democrats counter by saying skinflint Republican insistence on lower taxes hurts the economy. But the problem is multi-faceted. Public pensions have indeed reached levels that municipalities can no longer afford. California’s Prop 13, which limits the amount of property taxes, has reduced state income. Wall Street investment banks have loaned huge amounts in bonds knowing full well the loans were dicey. There is plenty of blame on all sides. What we need is a coming together of all these sides to work out how to help our increasingly financially imperiled cities.