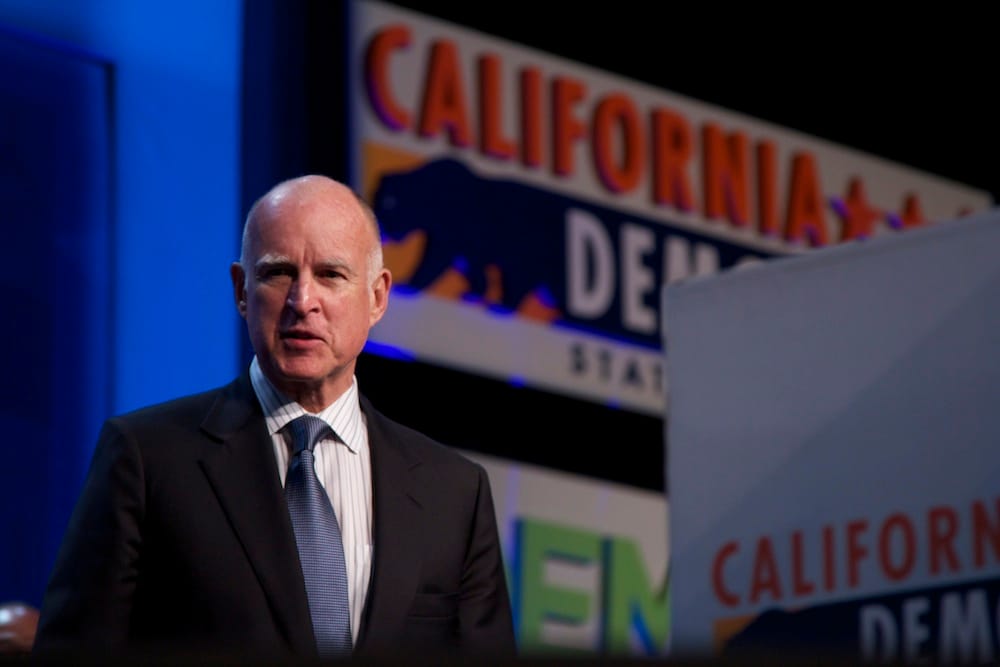

Gov. Brown Reaches Deal With Millionaire Tax Backers

Governor Jerry Brown announced today he has reached a compromise with a rival tax initiative group to combine ballot measures in an effort that will mix both proposals.

The move will see Gov. Brown's initiative combined with the so-called Millionaires Tax Initiative, backed by the Restoring California Coalition, comprising of the Courage Campaign, California Federation of Teachers, California Calls and ACCE.

“This united effort makes victory more likely and will go a long way toward balancing our budget and protecting our schools, universities and public safety,” said Governor Brown.

There has been continual speculation on the likelihood of three tax initiatives appearing on a November ballot, since competing measures were announced in January.

The combined proposal will increase sales tax by 1/4 of a cent, instead of 1/2 a cent, with the raise set to sunset in 2016. Proposed income tax increases are included as follows: 1% for incomes over $500,000 for couples or over $250,000 for individuals; 2% increase for incomes over $600,000 for couples or over $300,000 for individuals; 3% for incomes over $1 million for couples or over $500,000 for individuals.

"This responsible agreement will ask less of those who were hit hardest in the recession while ensuring that those who have profited the most contribute a larger share,” said Assembly Speaker John A. Pérez. "This is a major step forward as we work together to put California on the right track while eliminating our structural deficit.”

The Millionaire Tax proposal received support in early polling and was a large focus of student protests in Sacramento last week, while the Governor's plan received early business support. A third proposal, "Our Children, Our Future" brought forth by Los Angeles attorney Molly Munger is not included in the compromise. Munger's initiative would raise taxes across the board on Californians, except for the poorest.

Senate Pro Tem Darrell Steinberg said the deal will add $2 billion in more revenue than Gov. Brown's original plan.

“The beauty of this agreement is that it gives us the best chance to resolve the state’s chronic budget deficit," said Steinberg in a statement. "Doing so paves the way for us to move forward toward reinvesting in higher education, bringing down tuition and fees to expand accessibility and once again making a college education more affordable for thousands of Californians.”

Republican reaction to the compromise was less than positive, with many criticizing the way the deal was reached.

“We need jobs, not deals for special interests. These backroom deals are no way to govern,” said Chairman of the California Republican Party Tom Del Beccaro.

"Taxpayers have little to cheer by the Governor's decision to wave the white flag on the tax increase in his January budget," Assembly Republican Leader Connie Conway said in a statement. "The closed-door deal he cut today is little more than putting lipstick on a pig."

State Senate Republican Leader Bob Huff had similar sentiment, "This backroom tax increase deal does not bode well for the prospects of real public employee pension reform since it is now clear that the public employee unions are controlling the entire agenda."

The next step for the newly combined initiative is gather support before the deadline to qualify for the November ballot. Signatures previously gathered by both supporters of Gov. Brown's ballot proposal and the Millionaire Tax will not count, which means the compromise reached today must start over at collecting over 800,000 signatures needed.