California Cities Face Massive Budget Cuts, Default, Bankruptcy

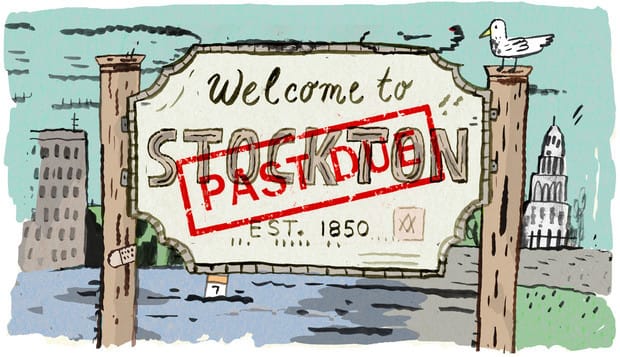

Many California municipalities are facing crushing bond and pension debt, while eviscerating budgets in attempts to stay solvent. Among the worst hit is the city of Stockton, whose city council recently voted to default on bond payments. It's a move widely seen as a precursor to filing for bankruptcy.

The city is now trying to negotiate terms with bond holders in hopes that bankruptcy can be avoided. Their city manager says there are no other alternatives. Stockton's budget has already been drastically reduced, salaries cut, and taxes raised. Doing more of the same is no longer an option. Their problems are an exaggerated version of what most California municipalities face. Pension obligations for retirees are expensive and rising. Debt brought on by financing during the real estate boom remains while the economy has yet to sufficiently recover. When real estate collapsed, so did revenue.

Real estate prices zoomed up in Stockton as workers in the Bay Area increasingly looked for housing they could afford. But when the bubble burst, there was no cushion, nothing to bounce off. Stockton is not near much of anything, agriculture is the primary industry, and there aren’t many jobs. Home prices have dropped by two-thirds. Violent crime has soared. Last year, Forbes ranked Stockton as the "#1 Most Miserable City” in the U.S.

Other cities have faced similar troubles. Vallejo emerged out of bankruptcy last year, but things are still dire. The police and fire departments are hugely reduced in size. Prostitution and drug use is now prevalent while neighborhood associations are doing what the police used to do. As cities continue to hollow out, neighborhood watch groups may become increasingly paramilitary in other cities and municipalities.

And Stockton and Vallejo are hardly alone. Bakersfield, Merced, Lincoln, Hercules and Half Moon Bay have also considered bankruptcy. Santa Ana is disbanding its 128 year old fire department and will contract fire and rescue out to the Orange County Fire Authority. They say it will save them $10 million a year. They currently have a shortfall of $30 million. El Segundo, Costa Mesa, and Monterey Park are considering similar moves.

Perhaps regionalizing resources is a strategy for cities to reduce debt, as it would cut training costs and provide economies of scale. But will the level of service be the same? This may help going forward but doesn’t reduce existing bond and pension debt. The only way that existing debt can be reduced is by renegotiating with debtors or breaking contracts due to a bankruptcy filing, some which many California cities may be doing soon.